defer capital gains tax australia

Deferral Of Capital Gains Via Reinvestment. However the Tax Cut and Jobs Act TCJA which took effect on Jan.

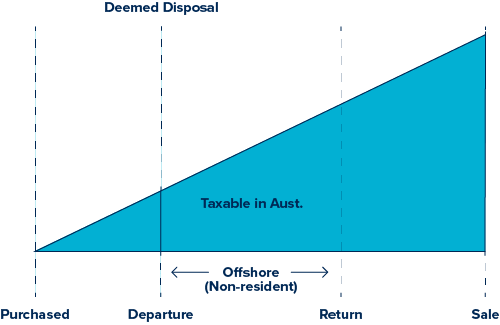

Leaving Australia To Live And Work Overseas Cgt Event I1 Deemed Disposal Of Investments Bdh Tax

If you have a capital gain it will.

. Moving from Australia to live in a new country or to return to your original country if you migrated to Australia can trigger unexpected tax issues under CGT Event I1 if you have investment assets. You can further reduce the capital gains tax from investment property by 50 because youve owned the property for more than 12 months. If you sell an active asset you can defer all or part of a capital gain for two years or longer if you acquire a replacement asset or incur expenditure on making capital improvements to an existing asset.

How to Avoid or Reduce Capital Gains Tax in Australia. This strategy can be applied to a wide variety of asset types and is a compelling alternative to more widely-known. How much is capital gains tax in Australia.

Generally you make your choice in your tax return but you can apply for an extension of time. Invest in a securities firm for at least one year and invest in the same stock firm for at least three years then reduce the amount of capital gains tax by 10 and 15. If you live in your property for at least six months once you purchase it you may be exempt from the capital gains tax.

The primary means of avoiding capital gains tax on the sale of an asset is the like-kind exchange provision under Code section 1031. An increase in value may occur either when you roll it over or when you defer itIn general when filing your taxes you have the choice of whether to submit it or notConsider extending the duration of your grant. Australian tax purposes when you cease to be an Australian tax resident there is a deemed disposal of your worldwide Capital Gains Tax.

We do not hold an Australian Financial. A Tax-Deferred Cash Out is a way of structuring the sale of an asset so that cash equivalent to a large fraction of the net selling price typically 935 can be received at closing while you defer capital gains tax 30 years. As the investment is an untaxed gain the taxpayers initial basis in the QOF is zero.

It is not a separate tax. At the moment the Australian Capital Gains Tax rate is 125 per cent and expats could be hit with it if they try to sell their home in Australia after these new tax rules come into affect on 1 July 2020. Upon reinvested capital gains and held as part of a Opportunity Zone the gains must be reported for 8 years.

You dont include the gain in your income until a change in circumstances causes a CGT event to happen. For individuals capital gains tax is calculated at the same rate as your income tax. Capital gains tax CGT is the tax you pay on profits from selling assets such as property.

Unless the property in question is real estate you have to pay capital gains tax on a disposition of a capital asset before reinvesting the proceeds. If youre looking for some ways to reduce your Capital Gains Tax here are some ideas. I work 1-3 days a week and my average income is about 200-300 minus tax 29 an hour before tax.

When it comes to property one of the major exemptions from Capital Gain Tax is if its your home or principal place of residence PPOR. But basically Im afraid that the chances of you minimizing or getting rid of capital gains tax by reinvesting just isnt a possibility but I would always speak to a tax accountant I am unable to give tax advice this is just my knowledge of the situation when it comes to capital gains tax. There are a few strategies you can use to eliminate or minimise the capital gains tax you pay on a property.

For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain. The gain is deferred until December 31 2026or to the year when the taxpayer withdraws the QOF assets if that occurs earlier. The investor is then exempt from income tax for that proportion of the income distributions they have received from the fund on a tax-deferred basis in the same financial year.

The Federal Government has made changes to Australian Capital Gains Tax for non residents that impacts Australian expats who still own a property back home. Defer capital gains tax australia. You report capital gains and capital losses in your income tax return and pay tax on your capital gains.

The higher the tax-deferred rate the higher the net value of the income to the investor in a given financial year. How Long Can You Defer Capital Gains Tax. August 1 2018 by Alan Collett.

A Australia does not have any system where you can defer CGT by rolling the profit into another investment. Although it is referred to as capital gains tax it is part of your income tax. One of the best ways to avoid paying capital gains taxes is to be an individual or a trust because youll get access to the capital gains tax general discount.

The 50 CGT discount will not be available for the non-resident period where an election is made to defer the. This is because Australia treats the cessation of tax residency in Australia as a Capital Gains Tax Event which can give rise to a deemed. That means that if you make a million in capital gains from the sale of your business assets or an investment you can lower the reported gains to 500000.

A Tax-deferred rate will be determined for each financial year eg. Can You Defer Capital Gains Tax In Australia. Fortunately the system does give you a 50 per cent discount on the tax payable if you.

1 2018 eliminated personal property assets such as stamp collections art and yes your stocks from like-kind exchange treatment. If you own the asset for more than twelve months however then youll receive a 50 discount. If youre in the third tax bracket your tax rate will be.

04 Aug 2021 QC 66018. The number one thing to remember is that this discount. However in this situation you must be able to prove its your primary place of residence.

For example a business can apply for an extension if it needs to replace a rollover asset and has not acquired the asset in the time allowed. My expenses are quite high and I need to continually draw on my savings. Avoiding CGT by living in the property.

Deferring Those Capital Gains Taxes Once upon a time you could have deferred capital gains taxes from the sale of that stock through use of a 1031 exchange. Australian Capital Gains Tax CGT implications of ceasing to be an Australian tax resident. No generally capital gains tax does not apply to inherited properties.

The 1031 exchange is an excellent tax planning tool when investors wish to defer the payment of any capital gain and depreciation recapture taxes generated from the sale or disposition of real property or personal property by reinvesting in replacement property. Does CGT apply on inherited properties. That lowers the taxable gain to AUD37500.

Sometimes you can choose to roll over a capital gain.

Managing Tax Rate Uncertainty Russell Investments

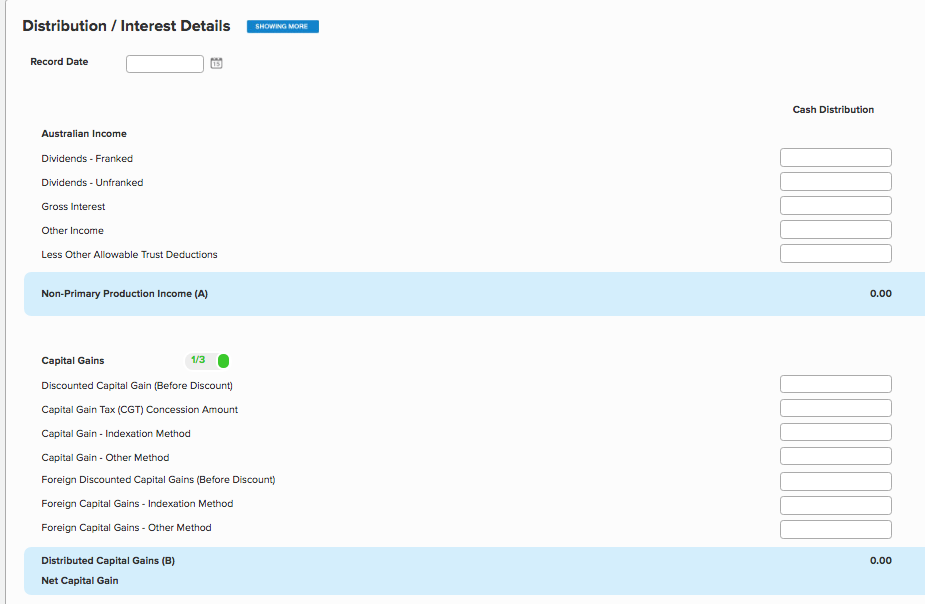

How To Enter A Distribution Tax Statement Simple Fund 360 Knowledge Centre

Can You Defer Capital Gains Tax In Australia Ictsd Org

How To Minimise Capital Gains Tax Australia Ictsd Org

How To Reduce Capital Gains Tax Australia Ictsd Org

How To Avoid Capital Gains Tax On Property In Australia Ictsd Org

What Is A Deemed Disposal Atlas Wealth Management

What Is Capital Gains Tax Cgt Everything About Cgt

Chapter 5 How To Avoid Uk Capital Gains Tax Learn More By Reading This

Managing Tax Rate Uncertainty Russell Investments

How Are Dividends Taxed Overview 2021 Tax Rates Examples

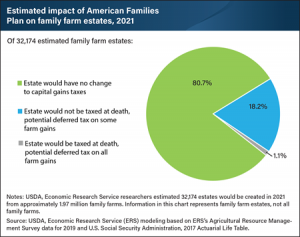

How Proposed Capital Gains Tax Changes Could Affect Family Farms Agdaily

Can You Defer Capital Gains Tax In Australia Ictsd Org

Capital Gains Tax How It Affects Commercial Property Commercial Loans

Deferring Capital Gains Tax When Selling Art

How To Calculate Capital Gains Tax On Property Australia Ictsd Org

Make Tax Free Capital Gains On Australian Shares Whilst A Non Resident Expat Expat Taxes Australia