maryland tax lien payment plan

This allows you to pay down the balance over time. If a taxpayer wants to avoid the tax lien they.

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

You may pay in full or make additional payments at any time.

. Office of Budget and Finance Attention. Updated Motor Vehicle Dealer Rules. Not only does Maryland not adopt the Made Whole Doctrine it specifically disclaims it.

This is a condition of an NSIA. Motor vehicle dealers must use Indiana sales tax return ST-103CAR through INTIME or another approved filing. You can apply for a short-term payment plan if you can pay your whole tax liability within 120 days.

The taxpayer will have a Notice of Federal Tax Lien filed. Send a check made payable to Baltimore County Maryland to. The day of the tax sale auction.

Enter first and last name and find anyones federa tax lien records. Website at wwwdatmarylandgov and type Homestead Tax Credit in the Search Bar or call 1-866-650-8783. A tax lien can make disposing or selling of property difficult.

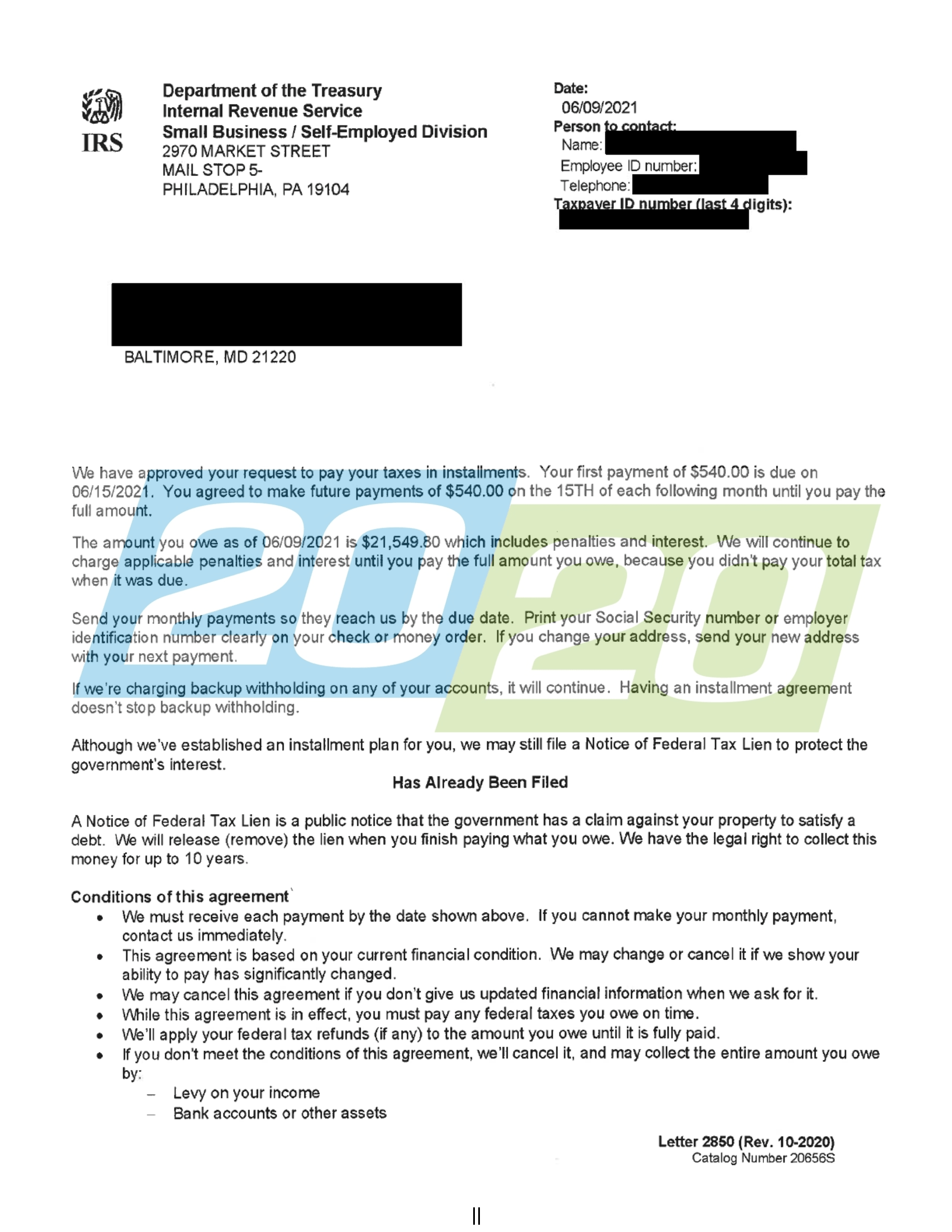

Payment for tax sale purchases will be made in the same manner. The IRS announced a new payment plan that now allows tax debtors who owe up to 250000 to pay on easier terms. The plan options available to you depend on your tax debt.

Co 740 A2d 46 Md. With the State of Maryland recurring direct debit program you dont have to worry about mailing off a check for your individual tax payment plan. If you violate the Maryland Power of Attorney Act Title 17 of the Estates and Trusts Article or act outside the authority granted you may be liable for any damages caused by your violation.

If you plan to mail a MD tax return on paper - find MD Maryland Forms and MD Mailing Addresses - your due date is Oct. A non-refundable registration fee is required payable via ACH. Also the tax lien is a public record and may limit the taxpayers ability to obtain credit.

If you owe taxes and you cant pay them all you have options. If you are assessed taxes you are unable to pay in a future tax year you can add that new balance to. 1999In Stancil the homeowners insurer that paid policy limits for fire destroying a home as a result of an automobile accident was entitled to subrogation from the tortfeasor before the insured was made whole.

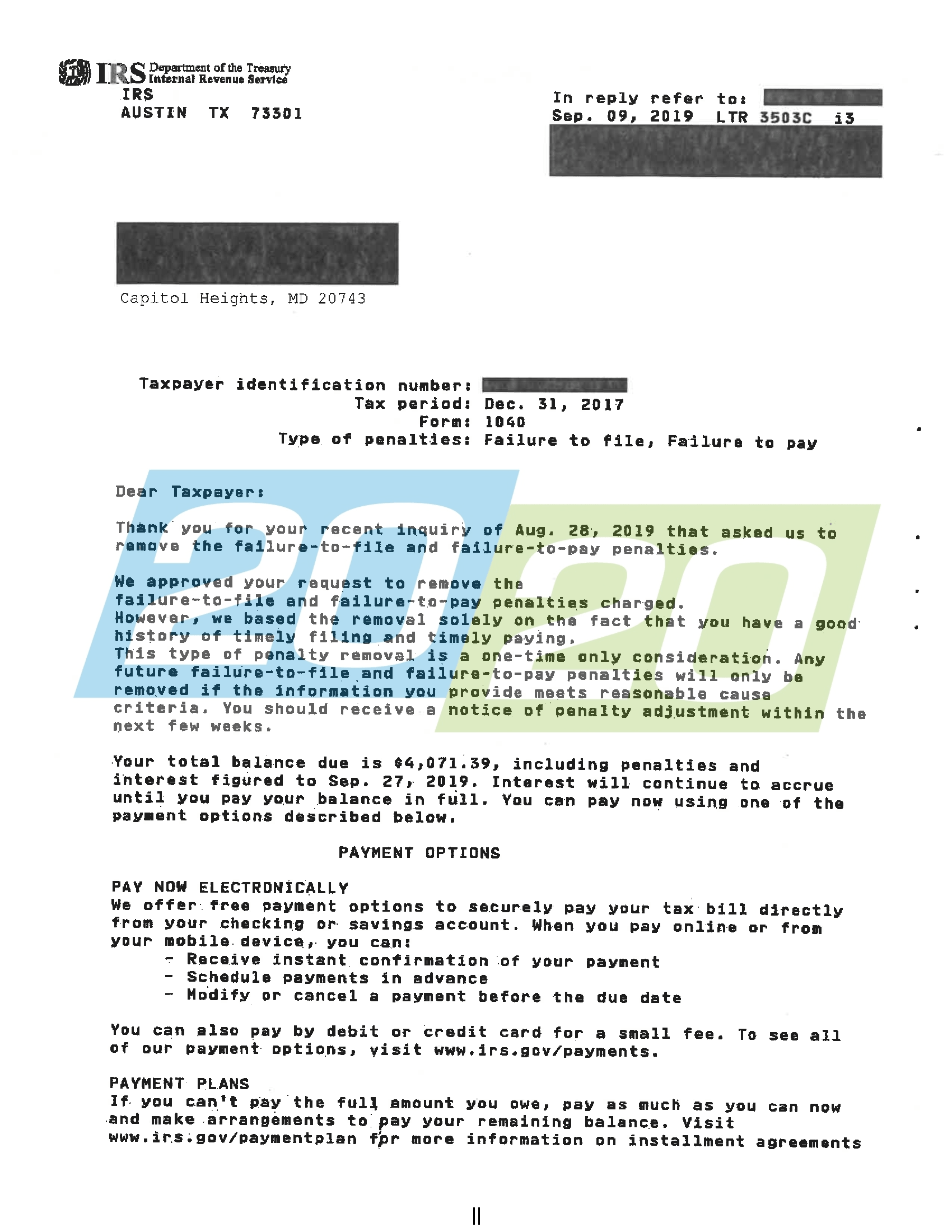

A tax lien may be filed against your personal property. I an assessment and ii a notice and demand for payment. Setting up a payment plan and keeping current with the payments will stop the government from taking any.

Get in touch with your state board of equalization if youre dealing with a tax lien that has been placed on a business property by your state or local government. The IRS is willing to work with someone who is faced with a tax liability. Payment must be made by 4 pm.

How to Figure Out Which IRS Payment Plan Is Best For You. Personal Property Section 400 Washington Avenue Room 150 Towson Maryland 21204-4665. Limited and Public Auctions of Tax Lien Certificates.

If a homeowner does not redeem the property after the tax sale the lien purchaser may file a civil action case in court to foreclose the owners right of redemption. Tax liens are public information thats free to see. Not entered into an installment agreement for payment of income tax.

Make payment by e-Check Debit Card. Most counties will not enter into a payment plan to keep a property out of tax sale. A Personal Property Lien Certificate is available for 55.

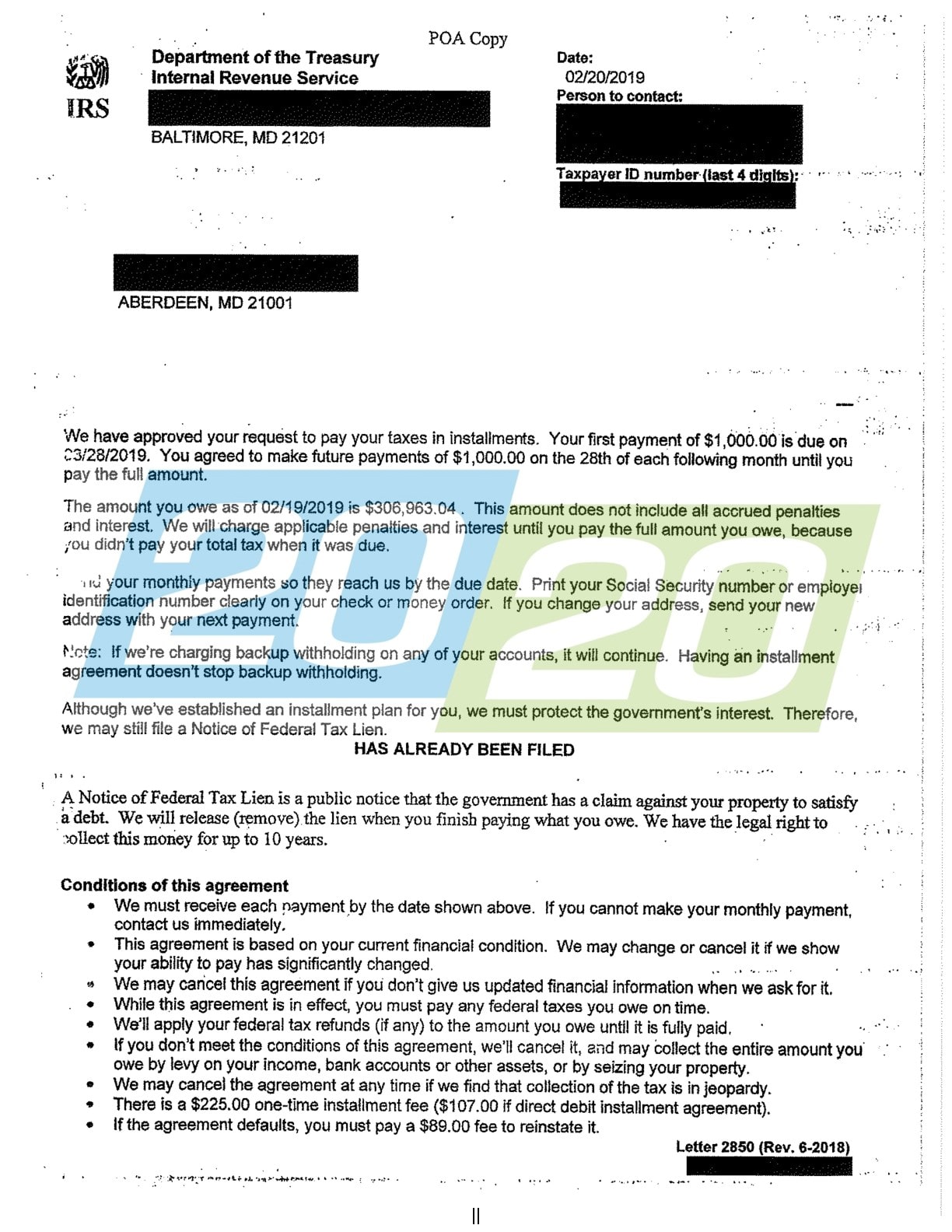

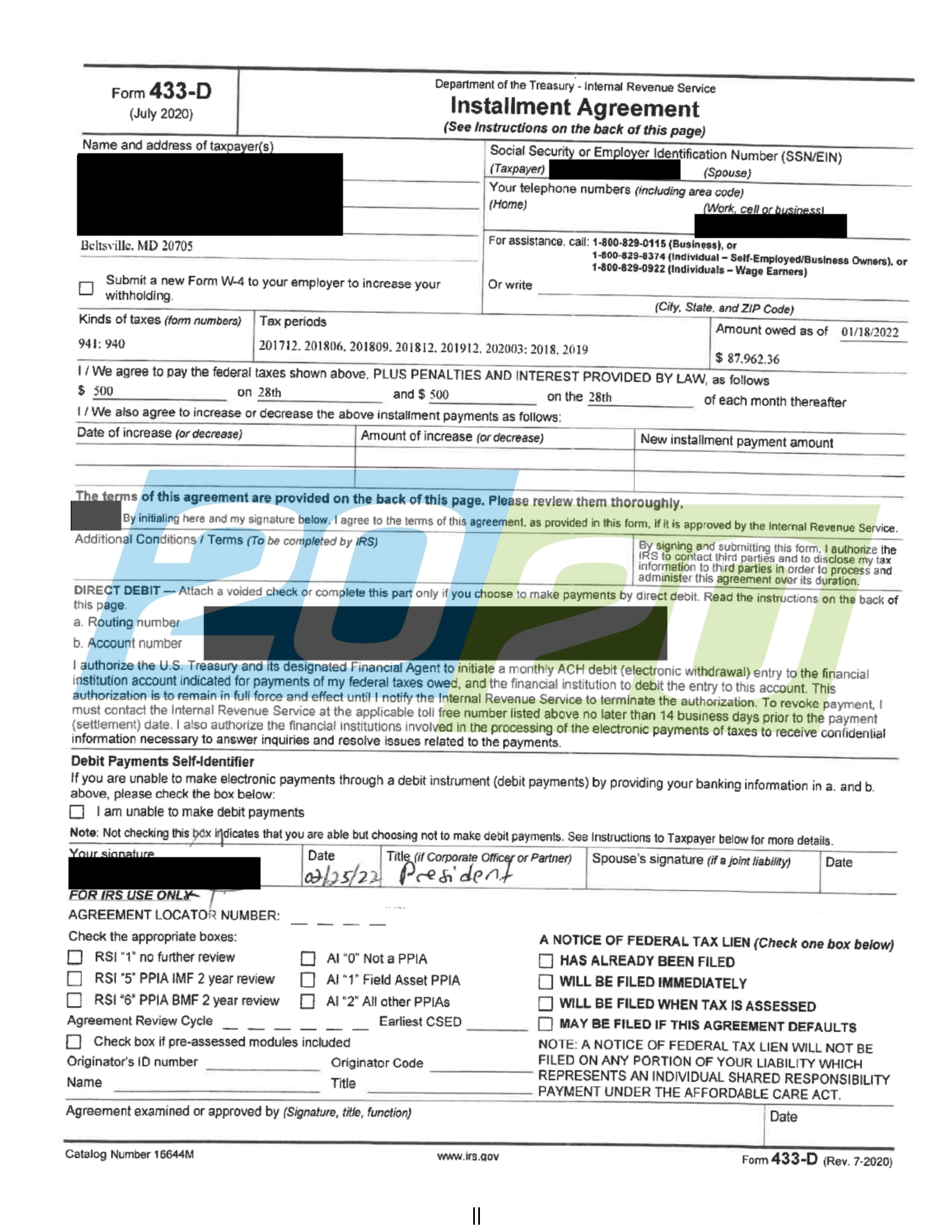

When you cannot pay the taxes you owe you can establish an installment agreement with the IRS. The Maryland General Assemblys Office of Legislative. Obtaining a Maryland Tax Payment Plan can be confusing for.

Frequently Asked Questions for Vehicle and Watercraft Dealers - Including dealer documentation requirements dealer-to-dealer sales issues sales tax for out-of-state transactions and more. However some counties will. Pre-registration of bidders is required.

An IRS payment plan allows you to make monthly payments towards your taxes owed. If you do not know your payment agreement number call our Collection Section at 410-974-2432 or 1-888-674-0016. While local and state government agencies can put a lien against your property most tax liens that individuals deal with are placed by the federal government for tax payment issues.

If you do not know your payment agreement number call our Collection Section at 410-974-2432 or 1-888-674-0016. The best feature of this new payment plan is that it is very easy to set up with the IRS. Return payments and insufficient funds will cause your payment plan to cancel and a 5000 Return Payment Penalty will be added to the account.

With the State of Maryland recurring direct debit program you dont have to worry about mailing off a check for your individual tax payment plan. If the total of all your tax liabilities penalties and interest is 50000 or less and youve filed all required returns then you may qualify for a long-term payment plan. For more information on Personal Property Tax Clearance Certificates call 410-887-2411.

The address is on the form. Moreover interest can continue to accrue during the life of the repayment plan although at a significantly reduced rate. The meaning of the authority granted to you is defined in the Maryland Power of Attorney Act Title 17 of the Estates and Trusts Article.

However for the federal tax lien to have priority against certain competing lien interests the IRS must also file a NFTL pursuant to IRC 6323. If you owe less than 100000 then you may qualify for a short-term plan. The Notice of Federal Tax Lien NFTL The federal tax lien arises by law when the IRS satisfies the prerequisites of IRC 6321.

17 2022 complete and sign 2021 Maryland Tax Forms online here on eFile then download print and mail them to the state tax agency. Any offsets or refunds applied to your account are not considered payment towards. There are a variety of other types of payment plans as well depending on the time needed to pay and the amount of taxes you owe.

Vehicle and Watercraft Information. The course consists of 78 hours of instruction in Maryland 89 hours of instruction in Oregon and 89 hours of instruction in California. TAX BILL PAYMENT OPTIONS INTERNET.

Defaulting on a payment plan can result in IRS collection actions such as a federal tax lien.

Tax Liabilities In Maryland Resolved 20 20 Tax Resolution

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Irs Tax Lien Vs Irs Tax Levy What S The Difference Call Maryland Tax Attorney Charles Dillon

Tax Liabilities In Maryland Resolved 20 20 Tax Resolution

Tax Liabilities In Maryland Resolved 20 20 Tax Resolution

Tax Liabilities In Maryland Resolved 20 20 Tax Resolution

How To Avoid A Maryland State Tax Lien

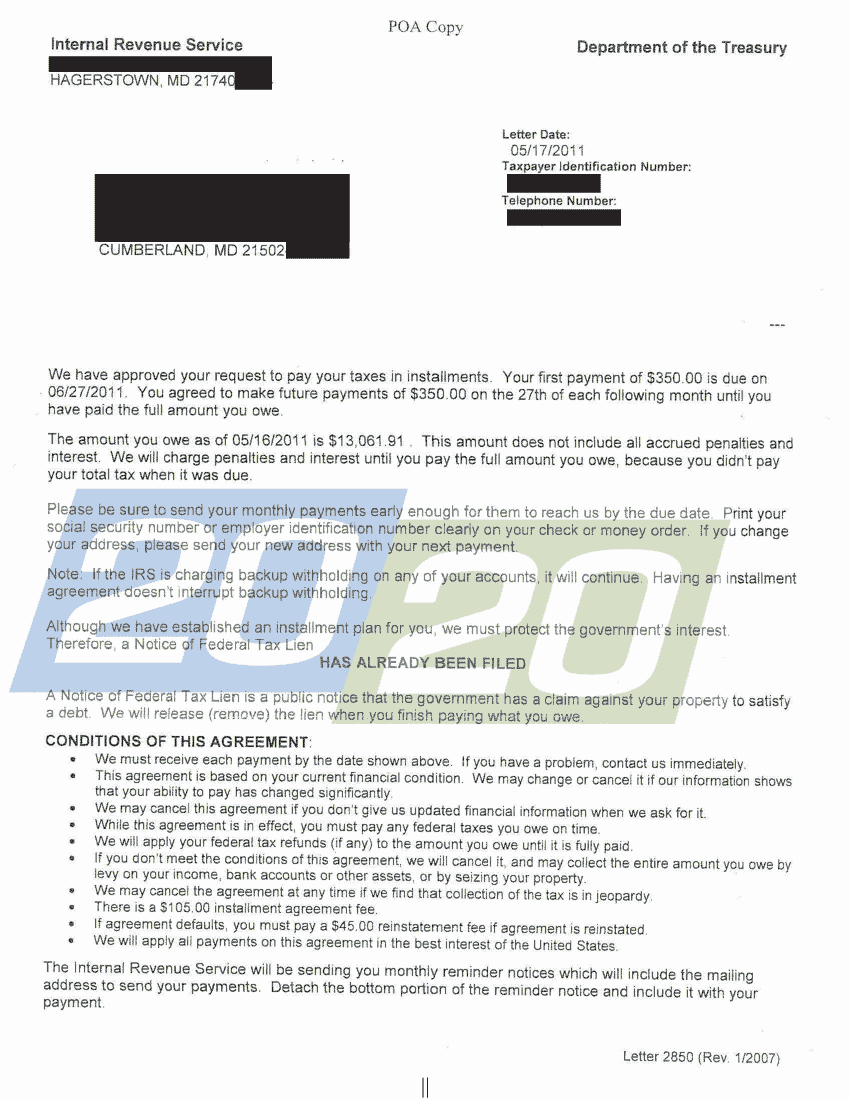

Irs Accepts Installment Agreement In Cumberland Md 20 20 Tax Resolution

Maryland Tax Payment Plan Tax Group Center

What Can Maryland Do If I Owe Taxes

5 12 3 Lien Release And Related Topics Internal Revenue Service

Maryland Maryland Estate Tax Return The Comptroller Of Maryland

Tax Liabilities In Maryland Resolved 20 20 Tax Resolution

5 12 3 Lien Release And Related Topics Internal Revenue Service

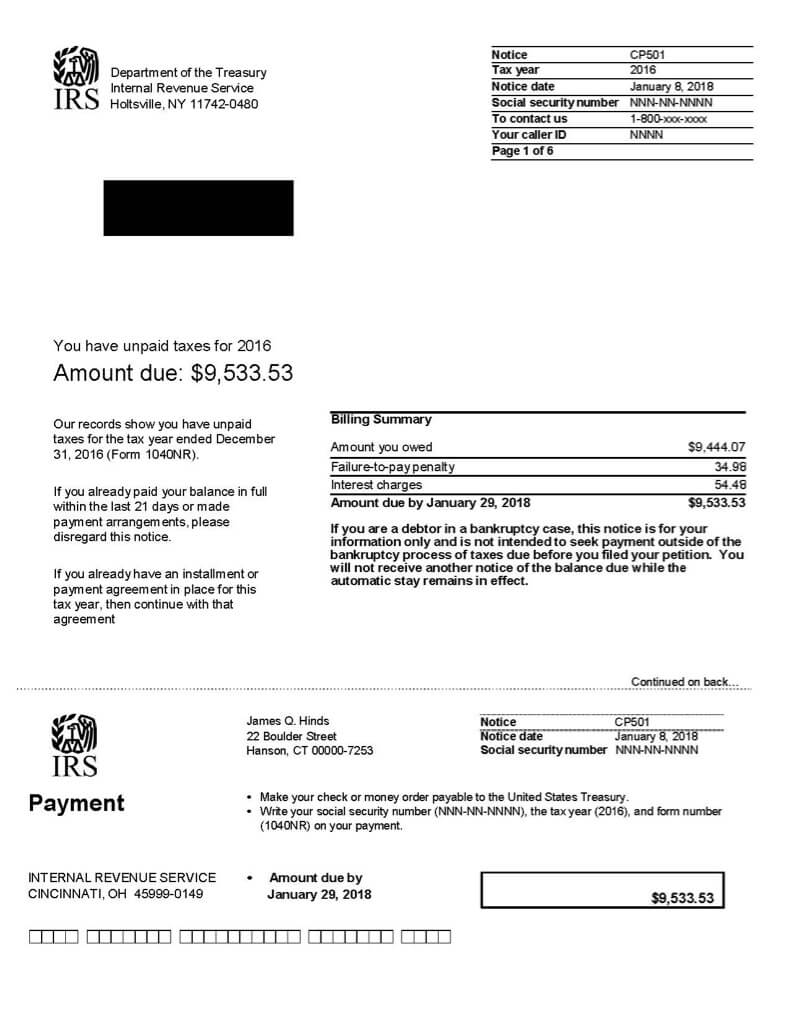

What Is A Cp501 Irs Notice Jackson Hewitt

Irs Letter 4458c Second Installment Agreement Skip H R Block

![]()

Dem Candidate Received State Tax Credits While Living In South Africa

Irs Accepts Installment Agreement In Glen Burnie Md 20 20 Tax Resolution