north dakota sales tax refund

Direct Deposit If your bank refuses a direct deposit of a refund we will mail a paper check to you at the address listed on your return. A claim for refund must be filed with the North Dakota Office of State Tax Commissioner Sales and Special Taxes 600 E.

The Effect Of Tax Laws On Commercial Real Estate Cyber Security Education Legit Work From Home School

This is an optional tax refund-related loan from MetaBank NA.

. How to Get Help Filing a North Dakota Sales Tax Return. Generally speaking if you spent more than 2500 in sales tax to a single vendor in the past year your purchase qualifies for a refund. North Dakota State Tax Refund Status Information.

With the launch of the new website also comes. You can check the status of your North Dakota income tax refund page. The state sales tax rate for most purchases of tangible personal property in North Dakota is 5 and local governments can impose their own taxes as well.

North Dakota Department of Taxation issues most refunds within 21 business days. The North Dakota Office of State Tax Commissioner is pleased to announce the launch of its new website wwwtaxndgov. TAX DAY NOW MAY 17th - There are -379 days left until taxes are due.

How to File Sales and Use Tax Resources. North Dakota sales tax is comprised of 2 parts. Taxpayers may also file North Dakota sales tax returns by completing and mailing Form ST.

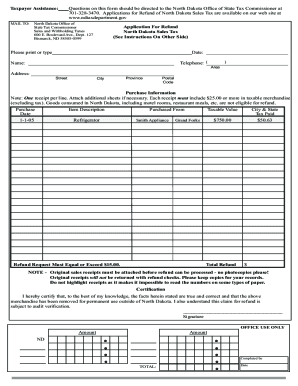

Tax Paid Purchase Item Description Date North Dakota Office of State Tax Commissioner Application For Refund North Dakota Sales Tax - Canadian Resident Name City Postal Code. Loans are offered in amounts of 250 500 750 1250 or 3500. Form 306 - Income Tax Withholding Return.

Taxable purchases must be a least. Use our detailed instructions to fill out and eSign your documents online. Your social security number.

You will need to know. The sales tax is paid by the purchaser and collected by the seller. Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of.

Written Determinations Sales and Use Tax. Your social security number. That means the effective rate.

North Dakota sales tax payments. Start filing your tax return now. Manage your North Dakota business tax accounts with Taxpayer Access point TAP.

Sales Use and Gross Receipts Tax Return to the following address. Quick guide on how to complete north dakota sales tax refund. You will need to know.

North Dakota Offi ce of State Tax Commissioner PO Box 5527 7013281241 taxregistrationndgov Bismarck ND 58506-5527 TDD. Approval and loan amount. If a joint return provide.

Lastly here is the contact information for the state in case you end up needing help. State Sales Tax The North Dakota sales tax rate is 5 for most retail. If you need access to a database of.

Sign the form and submit it by mail to. North Dakota first adopted a general state sales tax in 1935 and since that time the rate has risen to 5. The North Dakota Office of State Tax Commissioner would like to reach out to taxpayers regarding news you may see about returns and refunds being delayed on a national.

Refund Applied to Debt. It is not your tax refund. Office of State Tax.

Canadian residents may obtain a refund of North Dakota sales tax paid on qualifying purchases those purchased to be used exclusively outside the state. Your social security number. You may check the status of your refund on-line at North Dakota Tax Center.

On top of the state sales tax there may be one or more local sales taxes as well. Amended Returns and Refund Claims. To qualify for a refund Canadian residents must be in North Dakota specifi cally to make a purchase and the goods purchased must be.

127 Bismarck ND 58505. Sales and Use Tax Revenue Law. Forget about scanning and printing out forms.

You can check the status of your North Dakota income tax refund page. Refunds Things to Know. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view.

Where S My North Dakota State Tax Refund Taxact Blog

9 States Without An Income Tax Income Tax Income Tax

North Dakota Tax Refund Canada Fill Out And Sign Printable Pdf Template Signnow

How To File And Pay Sales Tax In North Dakota Taxvalet

Free Income Tax Calculators Amp Tax Tools Turbotax Official Tax Software Tax Refund Turbotax

North Dakota And Indiana Are The Latest To Join The List Of States That Have Approved At Least A Part Retirement Income Military Retirement Benefits Income Tax

How To File A Sales Tax Return In North Dakota

How To File And Pay Sales Tax In North Dakota Taxvalet

North Dakota Sales Tax Small Business Guide Truic

Farmland Average Value Per Acre Per State Farm Rural Land Tax Refund

South Dakota South Dakota State South Dakota Aberdeen South Dakota

How To File And Pay Sales Tax In North Dakota Taxvalet

How To File And Pay Sales Tax In North Dakota Taxvalet

Millions Of Businesses Small Medium Are Withheld From An Employee S Paycheck A Portion Is An Expense To T Sales Tax Goods And Service Tax Goods And Services

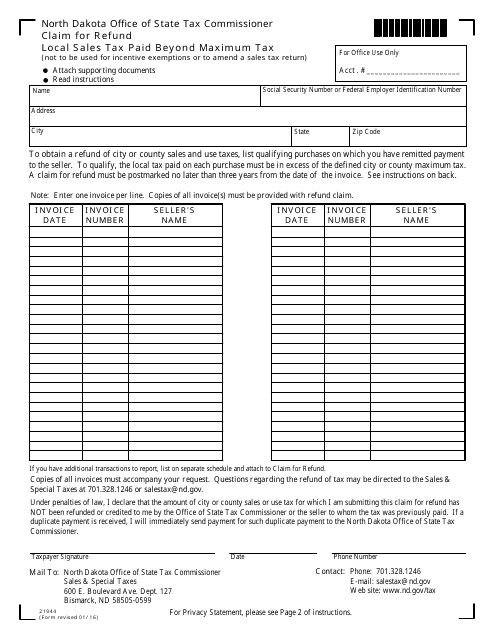

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax Brackets

This Graph Shows The Average Tax Refund In Every State Tax Refund Tax Refund

Where S My Refund Of North Dakota Taxes

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller